While at an appraisal inspection in the Fishtown section of Philadelphia I met a Realtor who asked a question that I get a lot. As he handed me the comparables sales he used to price the property, he asked…

While at an appraisal inspection in the Fishtown section of Philadelphia I met a Realtor who asked a question that I get a lot. As he handed me the comparables sales he used to price the property, he asked…

“Why can we only use sales that settled in the past six months?”

Ah, the old 6 Month Rule. Well, the truth is there is no rule set in stone that says appraisers can only use comparables that have sold in the last six months. While it would be ideal, that isn’t always possible.

It’s the appraiser’s job to identify the BEST comparables available. If that means going back 7 months, that’s OK. If it means going back 12 months, that’s OK. If it means going back 18 months, that’s OK, too. However, it is the appraiser’s responsibility to explain why they used sales older than six months.

For instance, if I have a perfect comparable located next door to the subject that sold 11 months ago…you bet I’m going to use it. I’d probably be remiss if I didn’t. As appraisers we can and should make time adjustments to reflect any movement in the market since the time of the older sale. Note: In our office, we start by setting our search parameters at 12 months for each assignment.

So, next time you’re meeting an appraiser and want to provide sales data, feel free to provide sales older than six months. I’d recommend no older than 12 months unless the sale is really relevant to the subject. I’d also recommend providing only truly comparable sales to the appraiser. You’d be amazed at the “comparables” we are given sometimes but, that’s a topic for another blog post.

The Coyle Group’s team of Philadelphia Real Estate Appraisers are a leading provider of appraisals for Estate/Probate, Divorce, Bankruptcy, Tax Appeal and Pre-Listing. If you need a guest speaker at your next sales meeting, please give us a call. We would welcome to opportunity to speak to your group and field any appraisal related questions you may have. For more information please visit our website at www.TheCoyleGroupLLC.com You can also contact The Coyle Group at 215-836-5500 or appraisals@coyleappraisals.com

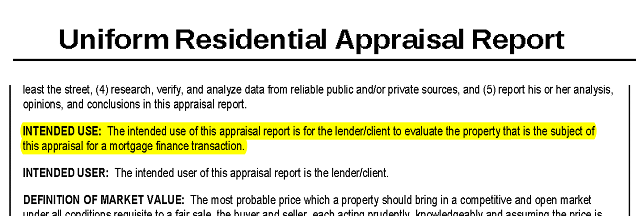

A real estate appraisal is one of the most critical parts of the

A real estate appraisal is one of the most critical parts of the

Latest Comments