Each year at The Coyle Group, we work with dozens of homeowners to appeal their real estate taxes. Honestly, getting letters like this from our clients still never gets old. Here’s one where our client received a 34% reduction in their assessment. In this case that translated into an annual tax savings of $18,875!!!

While results like this are not the norm, it’s nice to know that a well-prepared appraisal can help some tax payers see some pretty sweet reductions.

Tax Appeal Season starts sooner than you may think. If you or your clients are thinking about appealing their tax appeal assessment, you may want to start in early Spring 2018. Filing deadlines are typically in the beginning of August but, be sure to check with your county assessors office for the exact date.

The Coyle Group’s team of Philadelphia Real Estate Appraisers are a leading provider of appraisals for Estate/Probate, Divorce, Bankruptcy, Tax Appeal and Pre-Listing. If you need a guest speaker at your next sales meeting, please give us a call. We would welcome to opportunity to speak to your group and field any appraisal related questions you may have. For more information please visit our website at www.TheCoyleGroupLLC.com You can also contact The Coyle Group at 215-836-5500 or appraisals@coyleappraisals.com

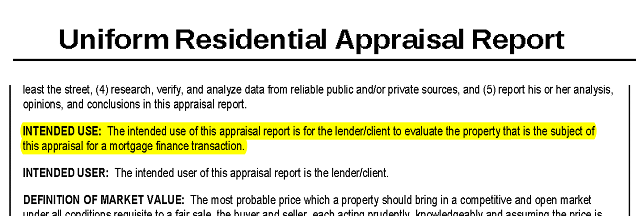

A real estate appraisal is one of the most critical parts of the

A real estate appraisal is one of the most critical parts of the

Latest Comments