If you’re an attorney or legal professional and engage the services of residential real estate appraisers for divorce, estates, bankruptcy or tax appeal, you need to read this. It could be the simple difference between your case succeeding or failing.

Most attorneys’ primary concern when they order an appraisal is the final value and how it will affect their case. They are usually not too worried with how the report is presented, so long as it is defensible. Many attorneys are used to receiving residential appraisals on the URAR 1004 Form which is the most commonly used Form for residential appraisals.

Why give it a second thought, right? Wrong. This could prove to be a huge mistake.

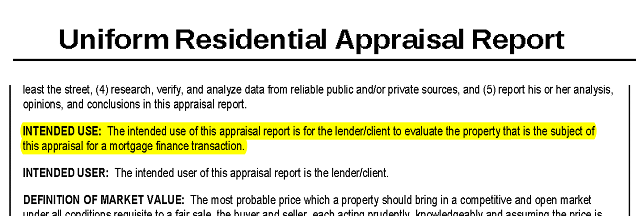

FACT: The common URAR 1004 Form is not intended to be used for valuation matters other than mortgage finance. (It even says so right in the report.)

Yet, all too often, this is the “go to” Form for appraisers who may not be experienced performing appraisal for legal purposes. Their mistake could cost you your case.

Imagine being in court for a hearing and presenting your appraisal prepared on the URAR 1004. While the court may not know the nuances of the Intended Use of a URAR 1004, a savvy opposing counsel, township solicitor or expert appraisal witness could very easily point this out. Technically, the report is invalid as a result of the Form’s Intended Use being violated by the appraiser. The court could deem the report inadmissible and jeopardize your client’s case.

There is a simple solution. There are a number of general purpose appraisal forms available to residential real estate appraisers that are also in compliance with USPAP*. They are typically called GPAR Forms (General Purpose Appraisal Report) and they address most residential usages (single family, multi-family and condo.) The Appraisal Institute has even developed its own USPAP compliant GP Forms as have most appraisal software providers.

So, next time when ordering an appraisal; be sure to specifically ask your appraiser which Form they intend use. If they say the URAR 1004, you need to insist that they use a GPAR Form or you run the risk of presenting an invalid appraisal.

Hopefully, you found this informative and helpful. If we can ever be of assistance with your appraisal needs for estates, divorce, bankruptcy and tax appeal; or if you have any appraisal related questions, please do not hesitate to contact us at 215.836.5500 or appraisals@coyleappraisals.com .

* USPAP: Uniform Standards of Professional Appraisal Practice

Great blog post. I recently went up against another appraiser in a divorce case that used a Fannie Mae form for the appraisal. It did not become an issue, but I was prepared to point it out if necessary.

I sat in on a few tax appeal hearings and watched the Board of Assessment reject appraisals and deny appeals for this reason alone. The homeowners were pretty upset to say the least and the appraisers looked pretty foolish, as well. Thanks for the comments, Gary.

Good article. If the predictability of Judges were known it would make our jobs easier pointing out others’ errors.

Good point. Thanks, Steven.

In the last 2 bankruptcy appraisals I did, the opposing appraisers completed them on the 1004 form, our side won both. I will disagree with you on one point, if the appraiser doesn’t already know to use the GPAR form, the attorney may want to consider using an appraiser that doesn’t need this explained to them. Great post.

Thanks for the comments, John. I totally agree with your point. If the appraiser is using Fannie forms for non-lender/legal work, the attorney should be looking for a new appraiser.

Very true. Using a copy written form for Secondary Market Use (Fannie & Freddie) undermines the appraisers credibility. If they miss something as fundamental as the wrong form, my bet is the report is most likely rife with other errors. Great post Michael.

Thanks, Jeff. I think it’s a lot more common than we want to admit.

Phil Crawford pointed this out on his show. If you’re going to be doing non lender work you should use the general purpose form. Great post.